You choose how to save on your home loan

We know it can be stressful when things change, but that doesn’t have to be the case for your home loan. When you roll off your fixed rate, we’ve got your back.

The Variable Home Loan combines an optional 100% offset account with flexible repayment options which means you can redraw your repayments if you’re ahead. We’re here to help you save money on your loan, however and whenever you can.

A loan that works for you

- Competitive variable interest rate.

- No ongoing monthly or annual fees.

- Optional 100% offset account to reduce the amount of interest you pay on your home loan.

- Choose to repay weekly, fortnightly, or monthly.

- Make extra payments without penalty, to pay off your home loan even faster.

- Redraw online if you’re ahead on your repayments.

How an offset account works

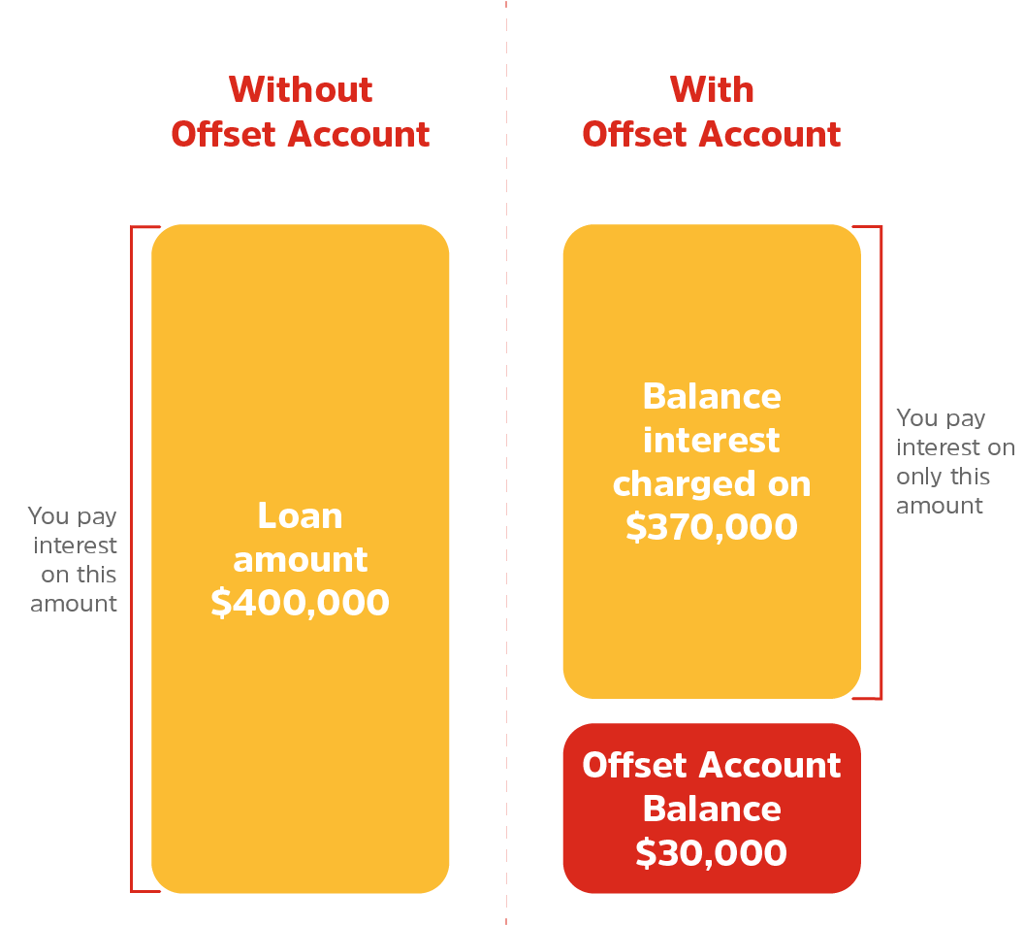

An offset account is an everyday bank account that’s linked to your home loan. It’s an almost-effortless way to reduce the interest on your home loan as every dollar in the account is offset against your home loan balance.

Whether you have $100, $1,000 or $10,000 in your offset account, the balance of your home loan will be reduced by this amount when interest is accrued. Deposit your salary into the account and get every dollar working hard until you spend it.

Rates & fees

Competitive interest rates, plus huge potential to reduce the interest you pay with your offset account.

The basics

| Loan purpose | Owner occupier or residential investment |

| Maximum loan term | 30 years |

| Optional linked offset account | & Access Account |

Interest rates

Owner occupier

| Loan to Value Ratio (LVR) | Variable rate |

Comparison rate*

|

|---|---|---|

| Less than 95% | 6.29% p.a. | 6.30% p.a. |

Investor

| Loan to Value Ratio (LVR) | Variable rate |

Comparison rate*

|

|---|---|---|

| Less than 90% | 6.49% p.a. | 6.50% p.a. |

| Fee type | |

|---|---|

| Monthly maintenance fee | $0 |

| Switch fee (from other P&N Bank loan) | $300.00 |

Other fees & charges that apply to all of our accounts can be found on our fees and charges page.

Your home loan questions answered

We are happy to review your current home loan rate to ensure you're on the best product for your situation. Please call us on 13 25 77 to speak with one of our experienced home loan specialists.

With a home loan offset account every dollar in your account is offset against your variable rate home loan balance.

For example if you have $1,000 dollars in your offset account, this will reduce the balance that your interest is calculated on by $1,000 dollars. That’s $1,000 dollars you’re not paying interest on, so more of each repayment goes to paying off your loan rather than paying interest.

An offset account is not available on a fixed rate home loan.

One of our experienced home loan specialists can assist you with switching your home loan. We can meet with you at one of our branches, at your home or workplace, or even via video appointment.

You can also call us on 13 25 77 to make an appointment to speak one of our experienced home loan specialists.

When you split your home loan you can divide your debt into multiple loans (e.g. a fixed rate loan and a variable rate loan). This may help you to reduce the impact of interest rate fluctuations while retaining the features and benefits you want.

For example, a fixed rate loan gives you the confidence of knowing how much your repayments will be and protects you against rate rises. In comparison, a standard variable rate loan allows you to make extra repayments and gives you the flexibility to redraw them at any time, providing you meet the relevant requirements to do so.

If you'd like to speak to a home loan specialist to see if a split home loan can benefit you, please contact 13 25 77 or book an appointment online.

Important information

Banking and Credit products issued by Police & Nurses Limited (P&N Bank).

Any information on this website is general in nature and does not consider your personal needs, objectives or financial situation. Our rates are current as of today and can change at any time. Credit eligibility criteria, terms & conditions, fees & charges apply.

Please consider the terms and conditions and whether a product is right for you.

- View terms & conditions

- View fees and charges

- View credit guide

- Create a Home Loan Key Fact Sheet

- View LMI Information Fact Sheet

- View Target Market Determinations (TMDs)

*Comparison rate calculated on a loan amount of $150,000 over a term of 25 years based on monthly repayments. For variable Interest Only loans, comparison rates are based on an initial 3 year Interest Only period. For fixed Interest Only loans, comparison rates are based on an initial Interest Only period equal in length to the fixed period. During an Interest Only period, your Interest Only payments will not reduce your loan balance. This may mean you pay more interest over the life of the loan.

WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.