Maximum gain, minimum strain

A savvy investor is always looking for ways to maximise returns. And with the & Investor Loan you can too – thanks to competitive rates, flexible repayment options and an optional 100% offset savings account.

See how the & Investor Loan stacks up

- Competitive variable interest rate.

- No ongoing monthly or annual fees.

- Borrow up to 90% of the property value.

- Optional 100% offset account which means your savings can reduce the amount of interest you pay on your home loan.

- Choose repayments of interest only, or principal and interest.

- Choose to repay weekly, fortnightly, or monthly.

- Make extra payments without penalty, to pay off your home loan even faster.

- Redraw online, or pause, if you’re ahead on your repayments.

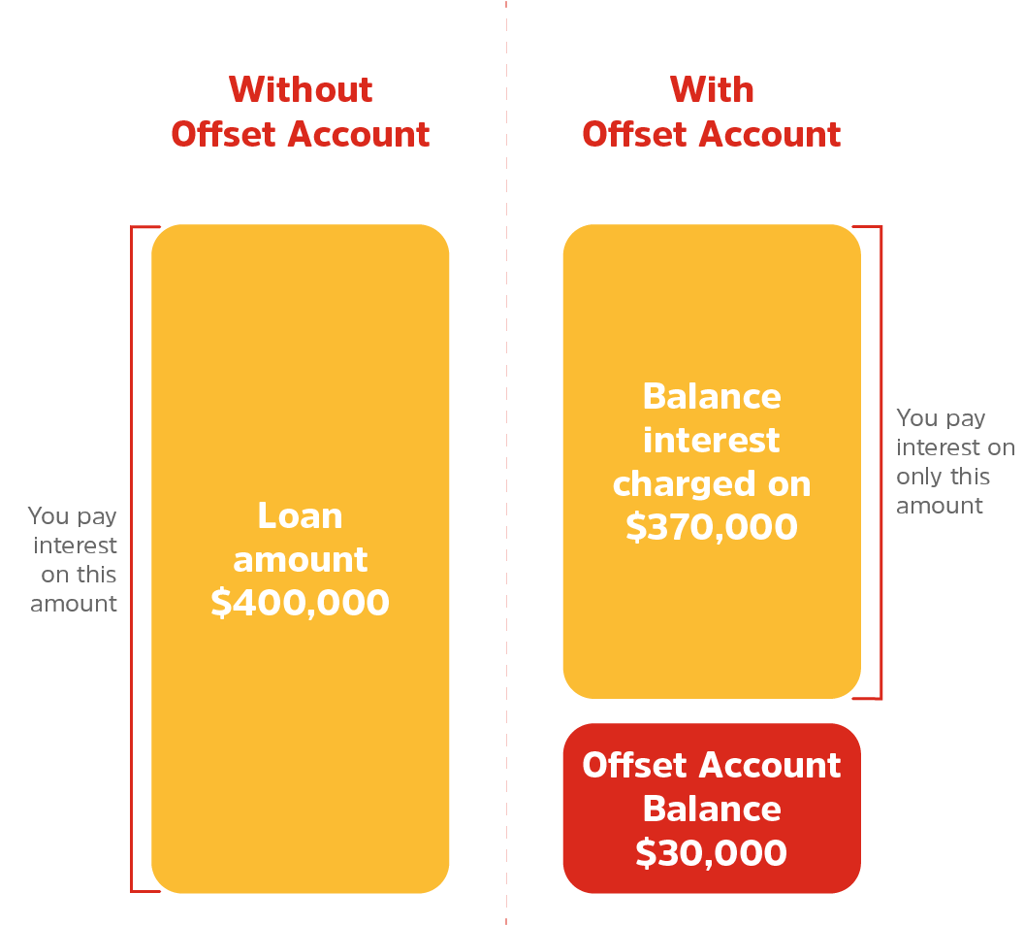

How an offset account works

An offset account is an everyday bank account that’s linked to your home loan. It’s an almost-effortless way to reduce the interest on your home loan as every dollar in the account is offset against your home loan balance.

Whether you have $100, $1,000 or $10,000 in your offset account, the balance of your home loan will be reduced by this amount when interest is accrued. Deposit your salary into the account and get every dollar working hard until you spend it.

Rates & fees

An optional offset account to help you save.

The basics

| Loan purpose | Residential investment property |

| Minimum loan amount | $20,000 |

| Maximum loan term | 30 years |

| Optional linked offset account | & Access Account |

Interest rates

Principal and interest repayments

| Loan to Value Ratio (LVR) | Variable rate |

Comparison rate*

|

|---|---|---|

| Less than 90% | 6.49% p.a. | 6.52% p.a. |

Interest only repayments

| Loan to Value Ratio (LVR) | Variable rate |

Comparison rate*

|

|---|---|---|

| Less than 90% | 6.79% p.a. | 6.61% p.a. |

Fee type |

|

|---|---|

| Monthly maintenance fee | $0 |

| Document preparation fee | $300.00 |

| Switch fee (from other P&N Bank loan) | $300.00 |

Other fees & charges that apply to all of our accounts can be found on our fees and charges page.

Ready to apply for your investment property loan?

Saving money and paying off your residential investment home loan sooner is easy with P&N. And we’ve made applying for your loan just as easy.

You can apply:

- In your nearest branch – remember to bring all your ID and supporting documentation.

- Over the phone – call us on 13 25 77 and one of our friendly loan consultants will help you with your home loan application.

- At home or at work – our mobile lending team can come to you, or we can set up a video call.

Applying for your home loan is easier and quicker when you've got what you need, so be prepared with your:

- Identity documents

- primary photo ID (e.g. passport or driver's licence), or

- primary ID without a photo (e.g. birth certificate or citizenship certificate) and a secondary ID (e.g. a utility bill with your name and address on it).

- Employment details – contact details of your current and previous employer if less than 2 years.

- Income details – payslips or, if you're self-employed, tax assessments for the last two years, and financial statements.

- Regular expenses – such as food, rent, electricity, telcos, insurance & medical costs.

- Assets – a rundown of any assets that you own (any cars, deposit accounts, home contents, properties, investments).

- Liabilities – the details of any loans, credit cards, pay later or other debts you have.

Got everything? Let’s get your application started.

Book an appointmentSaving money and paying off your residential investment home loan sooner is easy with P&N. And we’ve made applying for your loan just as easy.

You can apply:

- In your nearest branch – remember to bring all your ID and supporting documentation.

- Over the phone – call us on 13 25 77 and one of our friendly loan consultants will help you with your home loan application.

- At home or at work – our mobile lending team can come to you, or we can set up a video call.

Applying for your home loan is easier and quicker when you've got what you need, so be prepared with your:

- Identity documents

- primary photo ID (e.g. passport or driver's licence), or

- primary ID without a photo (e.g. birth certificate or citizenship certificate) and a secondary ID (e.g. a utility bill with your name and address on it).

- Employment details – contact details of your current and previous employer if less than 2 years.

- Income details – payslips or, if you're self-employed, tax assessments for the last two years, and financial statements.

- Regular expenses – such as food, rent, electricity, telcos, insurance & medical costs.

- Assets – a rundown of any assets that you own (any cars, deposit accounts, home contents, properties, investments).

- Liabilities – the details of any loans, credit cards, pay later or other debts you have.

Got everything? Let’s get your application started.

Book an appointment

Your home loan questions answered

Principal and interest repayments are when you pay off a portion of the principal balance of the loan (the amount you originally borrowed) plus the interest charges with every repayment you make.

Interest only repayments are as the name suggests - you're repaying the home loan interest charges only, calculated over your loan term and charged monthly. You'll not be paying off any of the principal balance of the loan. Interest only payments apply for an initial maximum period of 5 years.

Principal and interest repayments will apply once an interest only term has matured. You'll receive plenty of notice on your maturing interest only period and what your new principal and interest repayments will be. This will give you an opportunity to review your lending facilities.

A loan's comparison rate is made up of the standard interest rate as well as any fees and charges associated with the loan. This helps you to know the true cost of a loan so you can compare loans accurately and make informed decisions when using comparison sites or considering different loan.

An offset account is a bank account linked to your home loan. The balance in your account is used to offset the outstanding balance of your loan, which reduces the amount of interest you’re charged. You can use your offset account the same way you would a transaction account, so it’s a great option to deposit your salary and manage your everyday banking.

A redraw facility is a feature available on some variable rate home loans, and isn't a separate bank account. It allows you to withdraw any extra money you've paid towards your home loan over and above your minimum required repayments.

Both offset accounts and redraw facilities can help reduce the amount of interest you pay on your home loan, which could mean you pay your loan off sooner.

With a home loan offset account every dollar in your account is offset against your variable rate home loan balance.

For example if you have $1,000 dollars in your offset account, this will reduce the balance that your interest is calculated on by $1,000 dollars. That’s $1,000 dollars you’re not paying interest on, so more of each repayment goes to paying off your loan rather than paying interest.

An offset account is not available on a fixed rate home loan.

Important information

Banking and Credit products issued by Police & Nurses Limited (P&N Bank).

Any information on this website is general in nature and does not consider your personal needs, objectives or financial situation. Our rates are current as of today and can change at any time. Credit eligibility criteria, terms & conditions, fees & charges apply.

Please consider the terms and conditions and whether a product is right for you.

- View terms & conditions

- View fees and charges

- View credit guide

- Create a Home Loan Key Fact Sheet

- View LMI Information Fact Sheet

- View Target Market Determinations (TMDs)

*Comparison rate calculated on a loan amount of $150,000 over a term of 25 years based on monthly repayments. For variable Interest Only loans, comparison rates are based on an initial 3 year Interest Only period. For fixed Interest Only loans, comparison rates are based on an initial Interest Only period equal in length to the fixed period. During an Interest Only period, your Interest Only payments will not reduce your loan balance. This may mean you pay more interest over the life of the loan.

WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.